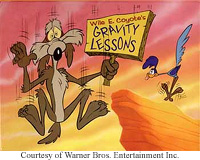

that Wile E. Coyote feeling

I generally try and post something neutral -- humorous on Friday, the better to gently slide everyone into the weekend.

I generally try and post something neutral -- humorous on Friday, the better to gently slide everyone into the weekend.Well, today is not such a Friday.

I critically examine many ideas and techologies that get discussed regarding peak energy, but I haven't come to any hard, fast conclusions about the outcome of our low energy future. I am not predicting a die-off, with scattered showers of locusts and cannibalism. Sure, I don't rule out any logical scenario, I'm somewhat gloomy by nature but not an out and out doomer.

So much for peak energy. At least for the moment -- more at the end of this post. Let's talk economy, where I have in fact come to some doomer-esque conclusions.

Big Gav brought a recent statement of Ken Deffeyes to my attention -- apparently he was down in Portland recently:

Deffeyes, the keynote speaker, is among the leaders in a growing faction of scientists, politicians, and activists-known as the Peak Oil movement-who are clamoring that the Age of Oil is about to end. Soon. In fact, Deffeyes predicts that global oil production will peak this Thanksgiving, thus beginning a long, painful slide to zero.Haha! No need to panic, though, right?

Judging from his own financial advice, Deffeyes is a strange choice to speak at an investment forum: Earlier in the day, he half-jokingly advised me to put my savings into 1/8th-ounce gold pieces. His argument: "They'll be easier to make change with" than larger pieces in a post-apocalyptic economy.

"We've lost control of the budget," Greenspan apparently told Breton during a bilateral meeting Saturday at the half-yearly World Bank/IMF Meetings, the French minister said at a press conference in Washington.What is the context for concern? Debt -- Deficit -- Didn't Reagan prove none of that matters?

The cost of Hurricane Katrina will cause the US budget deficit to rise by much more than expected this year, Breton said after meeting with Greenspan.

Mike "Mish" Shedlock, writing at the WhiskeyandGunpowder.com site, notes that these latest reports notwithstanding, the national debt is growing, and that the growth rate in the national debt limit totals to "a stunning $3,015 billion ($3.015 trillion) in additional debt in just four years." I admit that it is hard to get your mind around the idea that the Gross Domestic Product (GDP) of the USA is probably somewhere between $11 trillion and $12 trillion a year. So it is even harder to get your mind around the idea that in four short years we have borrowed- in Treasury debt alone! -the freaking equivalent of a quarter of everything America produces in goods and services in a whole freaking year! And this is just the INCREASE in the debt!Seperately, later in the same editorial, the praises of gold and silver are sung again:

And when you add in the additions to personal debt (mortgages and other credit debt) and the increases in business debt, you are probably looking at another quarter of GDP. Together they add up to around half of GDP! America and Americans together borrowed, in 48 months, the equivalent of half of everything we make in a whole freaking year! If your heart is trying to commit suicide by pounding and slamming itself into the walls of your chest and your brain is convulsed in spasms, then congratulations, as you are really starting to get the hang of this economics stuff.

But this is not to disparage gold. Alert reader Peter P. sent along an article from The Economist magazine "The price of gold reflects confidence, more than anything. When people are confident that their central banks will control inflation while permitting the economy to grow, when they believe that paper assets are worth something approaching their face value, they buy gold to wear but not to put in a safe. Alan Greenspan has achieved the remarkable feat of suspending disbelief in America's gerrymandered finances for the past few years. On his departure, watch the gold price soar."The stink rising from the American economy, and our creaky dollar, has caused turbanned and dusky foreigners to become alarmed. For example, note this chap writing for the Guardian:

The nice way, according to simulations by IMF staff, would involve a gradual slowdown in the pace of consumption in the US, accompanied by slightly higher real interest rates and a modest 15% devaluation in the dollar over a few years.I could go on for quite a spell, but I'll stop right there. The "nice way," describes a recession. The nasty way is more depressing.

The US current account would decline from 6% of GDP to 3.5% of GDP by 2010 and to 3% over the long run. The other main component of the soft-landing scenario would see a 15% appreciation of currencies in the developing countries of Asia - China, for the most part - which would result in their current account surpluses shrinking to 2% of GDP.

The nasty way involves a much sharper contraction in US activity. Under this scenario, the overseas investors who have been funding the American trade deficit by buying US assets decide they have had enough. The result is a large and sudden devaluation of the dollar, which adds to inflationary pressure and forces the Federal Reserve to raise short-term interest rates aggressively. Protectionist pressures mount and this, together with the big appreciation of China's currency, leads to much slower growth. With both the world's two big growth engines - the US and China - faltering, Europe and Japan also suffer. Financial markets suffer hefty losses, adding to the gloom.

And I'm in line for nasty. Not because it makes me happy. The American economy is sinking under the onslaught of treasury-depleting military adventures, hurricanes, drowned oil rigs, shut in natural gas giving us a taste of 2009, tax breaks for the wealthiest, record credit card delinquencies, double digit inflation... the list goes on.

And I'm in line for nasty. Not because it makes me happy. The American economy is sinking under the onslaught of treasury-depleting military adventures, hurricanes, drowned oil rigs, shut in natural gas giving us a taste of 2009, tax breaks for the wealthiest, record credit card delinquencies, double digit inflation... the list goes on.As far as I am concerned, the only reason the Stock Market is still floating above 10,000 in the U.S. is that not enough people have looked down.

When people start to realize there is nothing solid under their feet, gravity lessons will commence for the U.S. economy, and the global economy.

People who scoff at things such as gold investments now, causually linking gold bug fever to Y2k hysteria, will be eating dollars when commodities explode and discretionary and imaginary spending collapse.

Tying all of this to peak energy -- I would be concerned about going through peak oil even if the economy were in relatively good health, such as during the Clinton years.

I fear that economic depression will prevent us from addressing peak energy in a thoughtful, rigourous fashion.

But what the heck -- maybe I'm wrong, and next September we can all enjoy a good laugh as the Dow crests 12,000.

In "

In "