I expect some of my ideas regarding Peak Oil to seem contradictory, especially were one to survey some random posts from

Peak Energy. I will try and clarify why this is – and why it will continue.

The primary duality could be described by analogy to

Schrodinger's cat: is the poor grass monkey in the box alive or dead? It is unknown until it is observed.

Peak Oil puts Western Civilization in a similar box. After all the Hypercars are dreamed and ethanol brewed, there is still no guarantee of a pulse twenty years down the line. To observe the outcome of our experiment is to finally determine it.

Our civilization will struggle forward, perhaps with

better habits and a carbonated ocean, or it will collapse globally, local pockets of oil notwithstanding. There is no way to rationally assert an outcome at present.

The probability for a good outcome will naturally increase if active steps are taken to honestly frame and address our problems by an international coalition of governments.

The Rimini Protocol is a good example of

a positive idea. It might undergird our civilization, providing a stable platform for addressing global energy solutions.

The Rimini protocol is also a

wild-ass crazy idea, entertained by certain holy fools, oil geeks, and few others. It describes a future unthought and unrealized by most people living in our civilization.

This goes to the core of Peak Oil duality as I perceive it.

Oil is “built” into our civilization. Peak Oil could, even now, at this late date, be addressed with serious effort. Apollo like energy projects. Conservation plans:

Jimmy Carter-esque mandates to stop being wasteful.

None of this is happening.

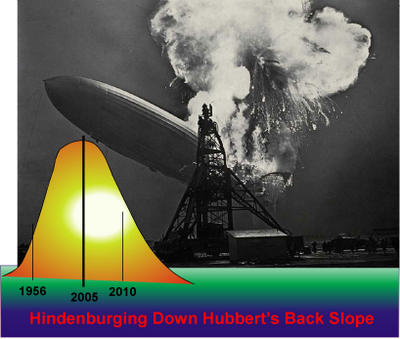

Oil Shock – via

Richard Daughty• The largest declines in oil production last year occurred in the U.S., where output fell by 160,000 barrels a day, and in Britain, where output declined by 230,000 barrels a day. We're near the bottom of the barrel for many of America's oil fields.• America imports 58% of its oil -- and we import more and more oil all the time. In fact, U.S. oil imports jumped 5.3% last year over 2003, versus a 5% rise for the world. So our dependency on oil from people who'd like to kill us is increasing, and increasing faster than the global average.…Today's energy crisis is transforming the world -- from geopolitics to the financial markets to the gas pump to the price of 75% of everything you consume on a daily basis.I'd like to be able to tell you that the U.S. government is doing everything it can to prepare for the coming energy emergency...but I can't. In fact, when I think about how little prepared this country is for the changes that are about to hit us, my hands automatically clench into fists. America is unprepared -- but YOU don't have to be.

So the duality can be expressed thusly: Regarding the post-peak era, good things could happen. But there is no evidence that they will.

Our civilization has a high level of complexity, driven by the present glut of energy. You can’t replace a river of oil with a can-do attitude and elbow grease.

When you fly to Europe from the United States, approximately the same amount of energy is used as was expended in the building of the Great Pyramid at Giza.Individuals should prepare for the worst and work for the best. Duality.

Harmonizing these two outcomes can lead to some surprising conclusions. Most “knowledge workers” I know view investing in precious metals such as gold and silver hopelessly old fashioned and tainted by Y2K hysteria. Few suspect that in a few years, “intellectual property” will be about as valuable as an investment condo in a saturated housing market.

With or without the comfortable auspices of your local neighborhood supermarket, we’re entering a bull run for commodities. No one will lose their shirt on commodities if civilization sticks around with its bevy comfortable human interfaces. In fact, one should make a bundle, just as happened in the 1970’s.

If we ascend into anarchy,

having a pile of doubloons gives one something to barter with besides personal labor potential.