Oil breaks 80 dollars on supply, storm fearsCrude oil prices burst into record territory Wednesday as New York futures topped 80 dollars a barrel, with traders fretting over a big drop in US reserves and a new tropical storm in the Gulf of Mexico.The contract for light, sweet crude for October delivery closed at 79.91 dollars, a jump of 1.68 dollars, after peaking at 80.18 dollars.Fundamentals.Back in August of 2005, there existed

a moment of freako excitement as oil prices crested $65. The dollar index at that time hovered around 88. Fast forward two years and a month, and the dollar index is is swirling around 80 and oil (surprise) has galloped upwards to a non-coincidental price of 80 dollars a barrel.

Non-coincidental simply because as the dollar falls, oil will rise. This moment was inevitable, and both indexes will continue their journey in opposite directions. Supply is not necessarily relevant, with the dollar so perilously weak.

Then again, on the supply side, in an effort to smooth the jittery nerves of investors around the globe, OPEC has

over-promised an additional 500,000 barrels of crude a day to be pumped helter skelter beginning November 1st.

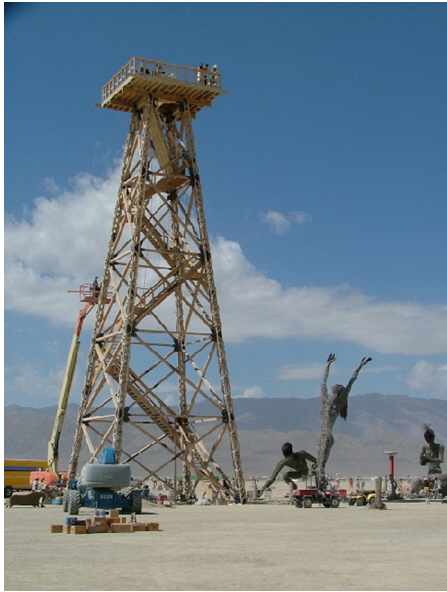

Sounds to me like the refineries best prepare for more of that slurried stinking sludge that passes for a

production increase in these latter days of the oil patch.

All oil isn't born Brent North Sea crude, you know.